Author(s):

Vanessa Hansford, Andrew W. Aziz, Lorraine Lynds, Shawn Cymbalisty, Jasveen Singh

Mar 13, 2024

On March 7, 2024, the Canadian Securities Administrators (CSA) released Staff Notice 81-334 (Revised) ESG-Related Investment Fund Disclosure (the Revised Notice). The Notice updates and replaces Staff Notice 81-334 which was issued on January 19, 2022 (the 2022 Notice).

While the Notice does not change the guidance that was in the 2022 Notice, it does expand on disclosure and sales communication practices of investment funds as they relate to environmental, social and governance (ESG) matters and, in particular, as it relates to different levels of disclosure expectations for funds whose investment objectives do not reference ESG factors but use ESG strategies.

Fund classification – ESG-related funds

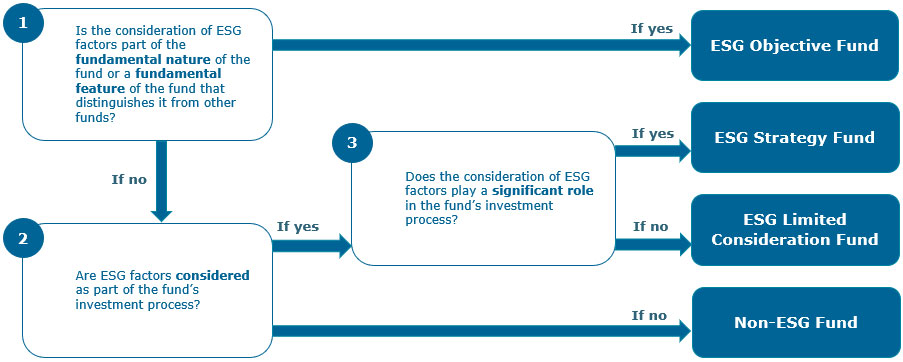

The Revised Notice provides for the classification of funds into one of the following four categories based on whether, and to what extent, a fund considers ESG factors as part of their investment process (in descending order of significance):

- ESG Objective Funds: Funds whose investment objectives reference ESG factors.

- ESG Strategy Funds: Funds whose investment objectives do not reference ESG factors but that use ESG strategies, where the consideration of ESG factors plays a significant role in the fund’s investment process.

- ESG Limited Consideration Funds: Funds whose investment objectives do not reference ESG factors but that use ESG strategies, where the consideration of ESG factors plays a limited role in the fund’s investment process. (ESG Limited Consideration Funds, ESG Objective Funds and ESG Strategy Funds are collectively referred to herein as the ESG-related funds.)

- Non-ESG Funds: Funds that do not consider ESG factors in their investment process.

The Revised Notice includes the following flowchart to assist with the classification of a fund in one of the four ESG categories described above.

The Revised Notice provides that investment fund managers (IFMs) should, in determining whether ESG factors play a significant role in a fund’s investment process, consider the following:

- Are ESG factors routinely weighted heavily in the investment process of the fund?

- Are ESG factors likely to drive or impact an investment decision?

- Are ESG factors always considered as part of the investment process?

- What purpose does the consideration of ESG factors serve for the fund?

Additional guidance

The Revised Notice includes additional guidance with respect to the following items:

- Investment objectives and fund names: A fund that references ESG in its name should primarily invest in assets that meet the fund’s ESG-related criteria. Funds that track the performance of an ESG-related index should include investment objectives and strategies that are consistent with the ESG focus(es) of the applicable ESG-related index which is included in the fund’s name. For funds that track the performance of an ESG-related index but do not include the name of the ESG-related index in their name, the fund’s investment objectives should clearly identify the ESG-related characteristics of any ESG-related index that the fund will track. Funds that track the performance of an ESG-related index where the fund is permitted to invest in issuers that are not constituents of the applicable ESG-related index should only invest in such issuers which have ESG characteristics that are similar to the constituent of the applicable ESG-related index.

- Funds that invest in underlying funds: For ESG Objective Funds that invest in underlying funds in order to meet their investment objectives, the ESG focus(es) of the underlying funds should be consistent with the ESG focus(es) of the fund.

- Funds that intend to generate a measurable ESG outcome: Where an ESG Objective Fund intends to generate a measurable ESG outcome, the funds should clearly state the intended outcome as part of their investment objectives in order to allow investors to identify funds that match their own ESG-related goals.

- Funds with carbon offset series: Funds, including crypto asset funds, may have a series with a distinguishing feature, such as a carbon offsetting feature. These series generally reference carbon offsetting in their name. If the name of the series refers to carbon offsetting, the investment objectives of the series should refer to, and explain, the carbon offsetting feature of the series and state that prior approval of securityholders of the series will be obtained before the carbon offset feature of the series is changed.

- Suitability: Where appropriate, an ESG Objective Fund may state that it is particularly suitable for investors who have ESG-related investment objectives or who are interested in ESG-focused investments. However, if the fund is only focused on a particular aspect of ESG, Staff’s view is that any suitability statement that indicates that the fund is particularly suitable for investors who have ESG-related investment objectives should accurately reflect the particular aspect(s) of ESG that the fund is focused on.

- Investment strategies disclosure: All ESG strategies (such as carbon offsetting) that are used as principal investment strategies or as part of a fund’s investment selection process, should be disclosed in the investment strategies section of the prospectus. In Staff’s view, the investment strategies disclosure of ESG Objective Funds and ESG Strategy Funds should include identifying any ESG factors used and explaining the meaning of each ESG factor and how the ESG factors are evaluated and monitored. This should include an explanation of the types of resources and information used and considered by the IFM in evaluating and monitoring the ESG factors (e.g., third-party sustainability reports, discussions with management or the issuer and disclosure documents), including disclosing whether the evaluation of the ESG factor is quantitative or qualitative and whether the evaluation is conducted using third-party data. For certain factors that may be complicated or non-self-explanatory, these factors should be explained clearly. If an ESG Objective Fund is not permitted to hold certain investments that appear to be inconsistent with ESG values at any point in time, IFMs are encouraged to disclose this in the fund’s investment strategies.

- ESG Limited Consideration Funds: Where an ESG Limited Consideration Fund includes statements about the fund’s use of ESG strategies (including its consideration of ESG factors in its investment process) in its prospectus, the disclosure should clearly explain

- the limited role that the consideration of ESG factors and/or use of ESG strategies plays in the fund’s investment process, including specific parts of the investment process during which ESG factors are considered, the weight given to ESG factors as a whole (rather than each particular ESG factor) and the impact that the ESG factors have on the portfolio selection process

- whether this approach is specific to the fund in question or part of the IFM’s general process that is applied across all or a segment of its funds and, if applied to only one or a segment of the IFM’s funds, clearly identify the fund(s)

ESG Limited Consideration Funds should avoid including disproportionately extensive disclosure about the consideration of ESG factors.

- Funds that use proxy voting or engagement in relation to ESG matters as a principal investment strategy: Disclosure should include a summary of the fund’s proxy voting policies and procedures (providing clarity about how the voting rights attached to the fund’s portfolio securities will be used to further the ESG Objective Fund’s ESG-related investment objectives and, in the case of an ESG Strategy Fund, how the ESG-related proxy voting strategy is implemented), the criteria used by the proxy voting or engagement strategy, the goal of the proxy voting or engagement strategy and the extent of the monitoring process used to assess the success of the proxy voting or engagement strategy. All ESG Objective Funds and ESG Strategy Funds that use ESG-focused shareholder or issuer engagement as a principal investment strategy should make their shareholder or issuer engagement policies and procedures publicly available in order to provide investors with greater transparency into the scope and nature of the fund’s use of engagement as an ESG strategy.

- Funds that are subject to IFMs' general proxy voting or engagement approaches that address ESG matters: Where a fund is an ESG Limited Consideration Fund, the investment strategies section of the prospectus may include disclosure about the consideration of ESG issues as part of the fund’s proxy voting or engagement approach but should not suggest that ESG-focused proxy voting or engagement is a principal investment strategy of the fund. Where such a fund is a Non-ESG Fund, the investment strategies section of the prospectus should not include disclosure about the consideration of ESG issues as part of its proxy voting or engagement approach.

- IFMs that apply an ESG strategy to more than one of their funds: Where there is disclosure about overall investment strategy used by an IFM, the disclosure should be clear about which of the funds in the prospectus the ESG strategy applies to in order to provide transparency to investors as to which specific funds managed by the IFM use the ESG strategy.

- Funds that use targets for specific ESG-related metrics: Such funds should disclose those targets as part of their investment strategies and identify if those targets may evolve or change over time in response to changing circumstances.

- Funds that invest in underlying funds: ESG Objective Funds and ESG Strategy Funds that invest in underlying funds that have an ESG-related focus and/or that employ ESG strategies must describe the process or criteria used to select the underlying funds and should disclose any parameters around the types of ESG focus(es) that the underlying funds will have.

- Funds that use multiple ESG strategies: ESG Objective Funds and ESG Strategy Funds that use multiple ESG strategies should provide disclosure explaining how the different ESG strategies are applied during the investment selection process. This should include the order in which the strategies are being applied, if this would have an impact on the fund.

- Funds that use ESG ratings, scores, indices or benchmarks: If internal or third-party ratings, scores, indices or benchmarks are used in disclosure, these should be clearly explained. Benchmarks or indices used should be identified and their methodology described.

- Funds that may not always use ESG strategies or that use them on a discretionary basis: The investment strategies disclosure should explain, where possible, when the ESG strategy will be used, including describing any parameters around when the ESG strategy will or will not be used. If a fund “may” exclude certain types of investments, the level and scope of the discretion should be disclosed.

- Funds whose names and/or investment objectives include the term “impact”: If a fund’s name and/or investment objectives include the term “impact”, the investment strategies disclosure should explain what type of impact the fund is aiming to achieve.

Sales communications of ESG-related funds

The Revised Notice also provides further guidance on the use of ESG-related statements in sales communications, including

- ESG Objective Funds: May include statements in sales communications that accurately reflect the extent to which the fund is focused on ESG, as well as the particular aspect(s) of ESG that the fund is focused on.

- ESG Strategy Funds: May include statements in sales communications that accurately reflect the types of ESG strategies used by the fund and the extent to which the fund uses ESG strategies. However, such funds should not exaggerate the extent of the fund’s focus on ESG in their sales communications.

- ESG Limited Consideration Funds: May include statements in sales communications regarding the fund’s use of ESG strategies as part of its investment process, but such statements should

- be clear about the limited role that the consideration of ESG factors plays in the fund’s investment process, including identifying the specific parts of the investment process in which ESG factors are considered, the weight given to ESG factors and the impact that ESG factors will have on the portfolio selection process

- only be included if disclosure relating to the limited role that the consideration of ESG factors plays in the funds’ investment process (including identifying the specific parts of the investment process in which ESG factors are considered) is included in the prospectus

- Non-ESG Funds: Should not refer to ESG in sales communications, with the exception of factual information about the ESG characteristics of its portfolio (such as fund-level ESG ratings, scores or rankings or ESG metrics). However, the factual information about the ESG characteristics of its portfolio should not be framed in a way that suggests that the Non-ESG Fund is aiming to achieve any ESG-related goals or is trying to create a portfolio that meets certain ESG-related criteria.

- Sales communications that include fund-level ESG ratings, scores or rankings: Fund-level ESG ratings, scores or rankings may be misleading for a number of reasons, including any of the following:

- there are conflicts of interest involving the provider that prepares the fund-level ESG rating, score or ranking

- the selection of the specific fund-level ESG rating, score or ranking is the result of cherry-picking fund-level ESG ratings, scores or rankings in order to present the fund’s ESG characteristics or performance in a positive light

- the selected fund-level ESG rating, score or ranking is not representative of the ESG characteristics or performance of the fund

- the sales communication does not include explanations, qualifications, limitations or other statements necessary or appropriate to make the inclusion of the fund-level ESG ratings, scores or rankings in the sales communication not misleading

- Commitments to ESG-related initiatives: IFMs that are signatories to, or participants in, ESG-related initiatives that are at the entity-level and that do not relate to the investment strategies of the funds managed by the IFM (including the IFM’s ESG investing approach), should ensure disclosure of the IFM’s signatory status or commitment to these initiatives should be clear that the commitment is at the entity level rather than at the fund level and, where applicable, that the funds managed by the IFM may not be focused on ESG.

ESG-related changes to existing funds

The Revised Notice provides guidance on ESG-related changes to existing funds, such as adding or removing references to ESG and whether such changes would, in Staff’s view, require the approval of securityholders, including name changes, changes in fundamental investment objectives and, if an ESG Objective Fund invests all of its assets in an underlying fund, if the underlying fund changes its ESG focus. The Revised Notice provides that where an ESG strategy is not a material or essential aspect of a fund and is therefore not included in the fund’s fundamental investment objectives, if that fund that adds, revises or removes disclosure about the ESG strategy in its investment strategies disclosure it would not be subject to the requirement to obtain prior securityholder approval.