The Emerging and High Growth Companies Group at Osler is passionate about entrepreneurship and supporting the growth of early and growth stage ventures. Ranked Band 1 in Chambers Canada and located in offices across the country, including Toronto, Vancouver, Montréal, Ottawa and Calgary, our knowledgeable and experienced team members share their insights and expertise with emerging companies to drive business value and to ensure long-term success.

Our group works closely and collaboratively with our Venture Capital teams to help clients recognize, develop and move forward on significant and innovative venture capital opportunities. We advise both emerging and high growth companies and investors nationwide on the unique issues involved in venture capital deals. Osler was ranked as the number one Canadian law firm in the inaugural global venture capital league tables, being the only Canadian firm ranked among the top five firms globally as advisor to both companies and investors.

We represent entrepreneurs and emerging and growth stage companies nationwide covering a broad spectrum of knowledge-based industries, supporting them through the stages of their lifecycle, providing legal advice on a wide range of issues and requirements faced along the way:

Osler has vibrant and ongoing relationships with the most prominent players in both Canada and the United States, including

leading venture capital funds

growth equity funds

private equity funds

pension funds

major corporations

institutions

growing private companies

IPOs

Through our established national network, our clients have access to potential funders, as well as to other sources of capital, service providers, potential board members, executives, customers and suppliers. Our strong legal referral community includes both international and domestic clients looking for business opportunities in Canada.

Osler’s transactional deal flow

Osler acts for more than 2,000 early, growth and late stages ventures and venture investors across Canada, the United States and around the world. From 2020 to 2023, Osler represented clients in the emerging and high growth companies space in 1,106 financing transactions, including preferred share equity financings and the issuance of convertible securities (such as Simple Agreements for Future Equity (SAFEs) and convertible promissory notes), with an aggregate deal value of approximately US$14.16 billion.

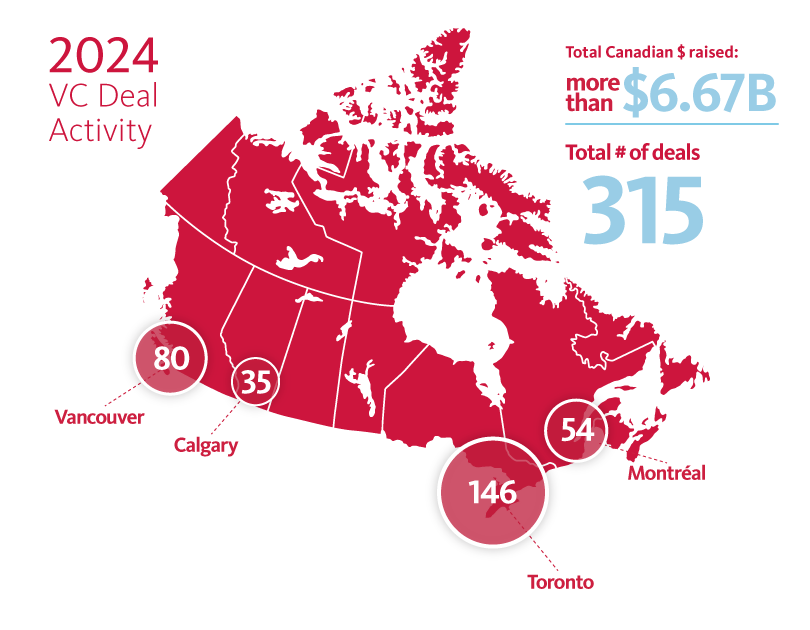

In 2023, Osler advised on 269 deals with more than $2.9 billion raised by EHG companies.

A summary of these deals is provided below.

Startup program for emerging companies

At Osler, we believe that establishing a foundation for your venture is the key to your future success. That is why we have carefully designed our startup program to get your venture up and running as quickly as possible, taking into account the standards for venture-backed companies.

Our startup program reflects our long-term commitment when working with emerging companies by providing the highest level of strategic advice and service on a fixed-fee basis. Even after an emerging company has graduated from the program, we are proactive in considering our clients’ needs and we will continue to deliver legal services on, as much as possible, a competitive fixed-fee basis or a recurring monthly fee basis (instead of the traditional hourly rate model) to provide cost certainty as the company scales and throughout its lifecycle.

Notable graduates of our startup program which have gone on to be successful enterprises include Wealthsimple, Clearco, Xanadu, ApplyBoard, Kepler, Untether AI, and Fusion Pharmaceuticals.

First of its kind

Osler’s Emerging and High Growth Companies Group is proud to have worked on the following deals that were notably mentioned for being the largest or first of its kind.

- Verafin – in its sale to NASDAQ for US $2.75B – the largest private tech M&A transaction.

- Clio – in its $900M Series F financing – the largest venture investment and growth equity financing in Canada’s technology sector in history.

- ApplyBoard – in its $100M Series C financing – led the company to a valuation of $2B, obtaining unicorn status.

- Wealthsimple – in its $114M equity financing – led the company to a valuation of $1.4B, obtaining unicorn status.

- Prodigy – in its $159M Series B financing – one of the largest raises in the Canadian EdTech space.

- Waabi – in its US $83.5M Series A financing – one of the largest Series A rounds ever raised by a Canadian startup.

- Symend – in its $73M Series B financing – one of the largest Series B rounds in Alberta history.

Many of Osler’s Emerging and High Growth clients are leading the way in fighting COVID-19. We are proud to work with these innovative companies that are at the forefront of fighting this disease with made-in-Canada solutions.

Supporting innovation nationwide

As part of our commitment to Canada’s broader community of entrepreneurs, Osler sponsors a number of programs and organizations across the country dedicated to supporting emerging companies. We are committed to the idea that founders with passion, vision and a plan can access the legal and business guidance they need to launch their venture.

Osler helped launch and continues to support the following

NEXT Canada (Next 36, Next AI and Next Founders), a non-profit charity that helps identify and fast-track the development of Canada’s most talented young innovators

Creative Destruction Lab (CDL Toronto, CDL Rockies, CDL Vancouver, CDL Montréal and CDL Atlantic), a seed stage program for massively scalable science and technology-based companies

We are also partnering with a number of early stage accelerators such as

Forum Ventures, a SaaS-focused accelerator which provides entrepreneurs with an opportunity to connect with an extensive network of enterprise companies, mentors and investors within the early stage B2B SaaS and enterprise technology space

L-Spark, another leading SaaS-focused accelerator dedicated to connecting Canada’s SaaS experts to market-ready SaaS and cloud companies

Osler also works with programs to promote women-led businesses such The 51, a “Financial Feminist” platform where investors and entrepreneurs work together to connect women-led capital for women-led businesses.

As well, Osler is a founding sponsor of The Next Big Thing, an entrepreneur-led foundation committed to the next generation of Canadian entrepreneurs. We are committed to working with our fellow sponsors at these and other ventures, such as Deloitte Fast 50, League of Innovators, Startup TNT, Front Row Ventures and the C100, to ensure that founders can access the support they need to launch their venture.

Deals

Osler represents companies and venture capital funds and investors from the pre-seed stage, right through to the high growth and exit stage. Our portfolio of experience demonstrates the broad range of deals and sectors that we have assisted and our ability to help companies to scale their business. Read about a selection of our recent deals below or access the full list in the Representative Work section of this page.

Pre-Seed

Simmunome in its securing $2 million of pre-seed funding

Seed

Inverted AI in its closing of a $5.3 million seed funding round

CentML in its securing of $37 million of seed funding

Series A

ContactMonkey in its $55 million Series A financing round

Series B

Arteria AI in its $46 million Series B financing round

ODAIA in its raising of $34 million Series B financing

Series C and beyond

Koho Financial in its raising of $86 million in a Series D funding round

M&A and Exits

Fusion Pharmaceuticals in its $212.5 million IPO

Inversago Pharma in its US$1.075 billion business combination with Novo Nordisk

Areas of Focus

Key Contacts

Co-Chair

Partner, Emerging and High Growth Companies, Toronto

Co-Chair

Vancouver Managing Partner, Vancouver

Partner, Emerging and High Growth Companies, Calgary

Partner, Emerging and High Growth Companies, Montréal

Latest Insights

-

Osler Update Feb 10, 2025

A practical approach to enhancing cybersecurity trust: standards and validation programs for SMEs

As cybersecurity threats become more prevalent, the need to implement cybersecurity controls based on accessible, pragmatic and achievable standards...

Read more -

Webinar Jan 31, 2025

Accelerate your ARR: proven strategies to fuel growth and impress investors

Join Osler and Growth Partners for an insightful session on accelerating your company’s Annual Recurring Revenue (ARR). Our panel features...

Read more -

Osler Update Jan 21, 2025

M&A transactions involving AI companies: representations and warranties

Companies that develop AI technologies have become highly attractive acquisition targets.

Read more -

Osler Update Dec 18, 2024

Declining hostile bids, IPOs and public companies

Canada has seen a decline in hostile take-over bids and a rise in shareholder activism, alongside a continued decrease in IPOs suggesting policy...

Read more

Stay up to date with our latest insights

SubscribeUpcoming Events

Awards and Recognition

-

Chambers Canada: The World's Leading Lawyers for Business: Recognized in Startups & Emerging Companies (Band 1)

-

Refinitiv: Recognized as the #1 Canadian law firm in the Global Venture Capital League Tables

Osler has ascended to being the preeminent technology financing and general tech law firm in Canada. No question...

In the Media

-

Osler News Feb 20, 2025

Osler welcomes 14 new partners and three new counsel in 2025

Osler is pleased to announce the addition of 14 new partners and three new counsel across our offices in Toronto, Montréal, Calgary and Vancouver.

Read more -

Osler News Dec 5, 2024

Osler ranked Band 1 in Chambers FinTech Guide 2025

Osler continues to be ranked as a leading firm as Band 1 in the 2025 edition of the Chambers FinTech Guide. This Chambers guide identifies and...

Read more -

Osler News Nov 28, 2024

Osler again ranked top Canadian firm by LSEG and Pitchbook

Osler is proud to be listed as the top-ranked Canadian legal advisor in LSEG’s (Refinitiv) global rankings for the first nine months of...

Read more -

Osler News Nov 6, 2024

21 Osler clients ranked on Deloitte’s 2024 Technology Fast 50

Osler is proud share that 21 of our clients are listed in Deloitte’s 2024 Technology Fast 50, Enterprise – Industry Leaders, Clean Technology,...

Read more